INVESTMENT PHILOSOPHY

The vision for WDBIH looking forward is to continue to be a women-owned and managed investment holding company but to increase our strategic value-add in our investee companies and to own a more significant stake in each company (both in monetary and percentage terms).

“Our investment strategy is to acquire significant minority interests (10%-49%) in growth and cash generative businesses with EV’s of > R500m, and to have representation on the respective company boards and sub-committees in order to drive our strategic active participation agenda.” – Nicola Gubb, Chief Investment Officer.

INVESTMENT MANDATE

WDBIH’s mandate is to make investments, but while other companies pay dividends to their investors, the majority of profits made by WDBIH through its investments are repatriated to the WDB Trust, which uses those funds for its developmental programmes

investment

OBJECTIVE

Target equity returns: WDBIH seeks to make equity investments in growth businesses that generate cash, and seek market and sector-related internal rates of return.

Investment horizon: We maintain long-term investment horizons, taking a longer strategic view of our investments, through various cycles, without the pressure of an exit.

Investee company profile: We invest in businesses with growth, strong cash generative ability and healthy dividend flow.

Efficient use of capital: We seek to maximise our capital return by reducing our cost of capital, through a combination of debt (including vendor and third party funding) and own equity.

Investment level: we seek to hold all our investments at holding company or group level.

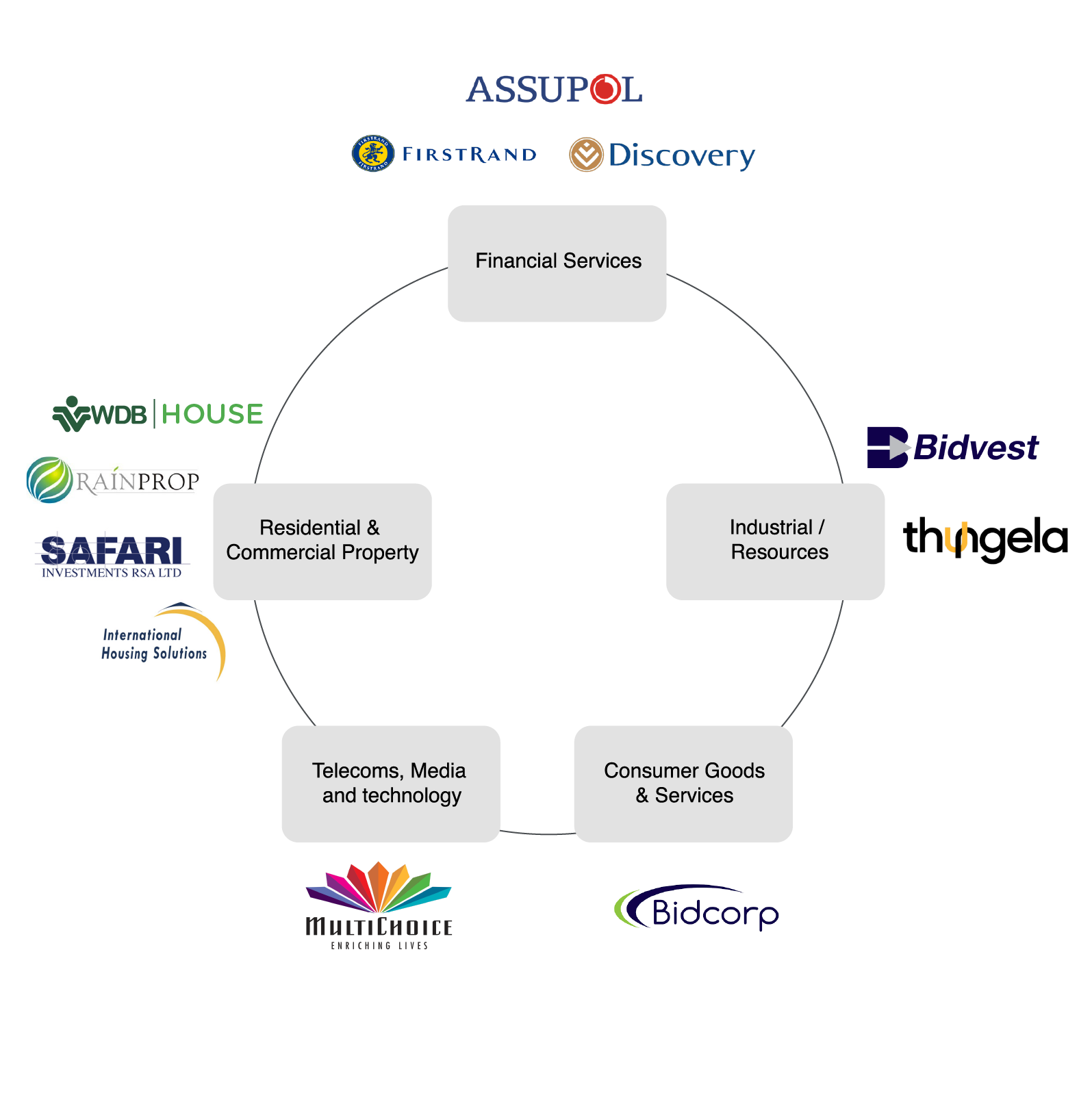

INVESTMENT PORTFOLIO

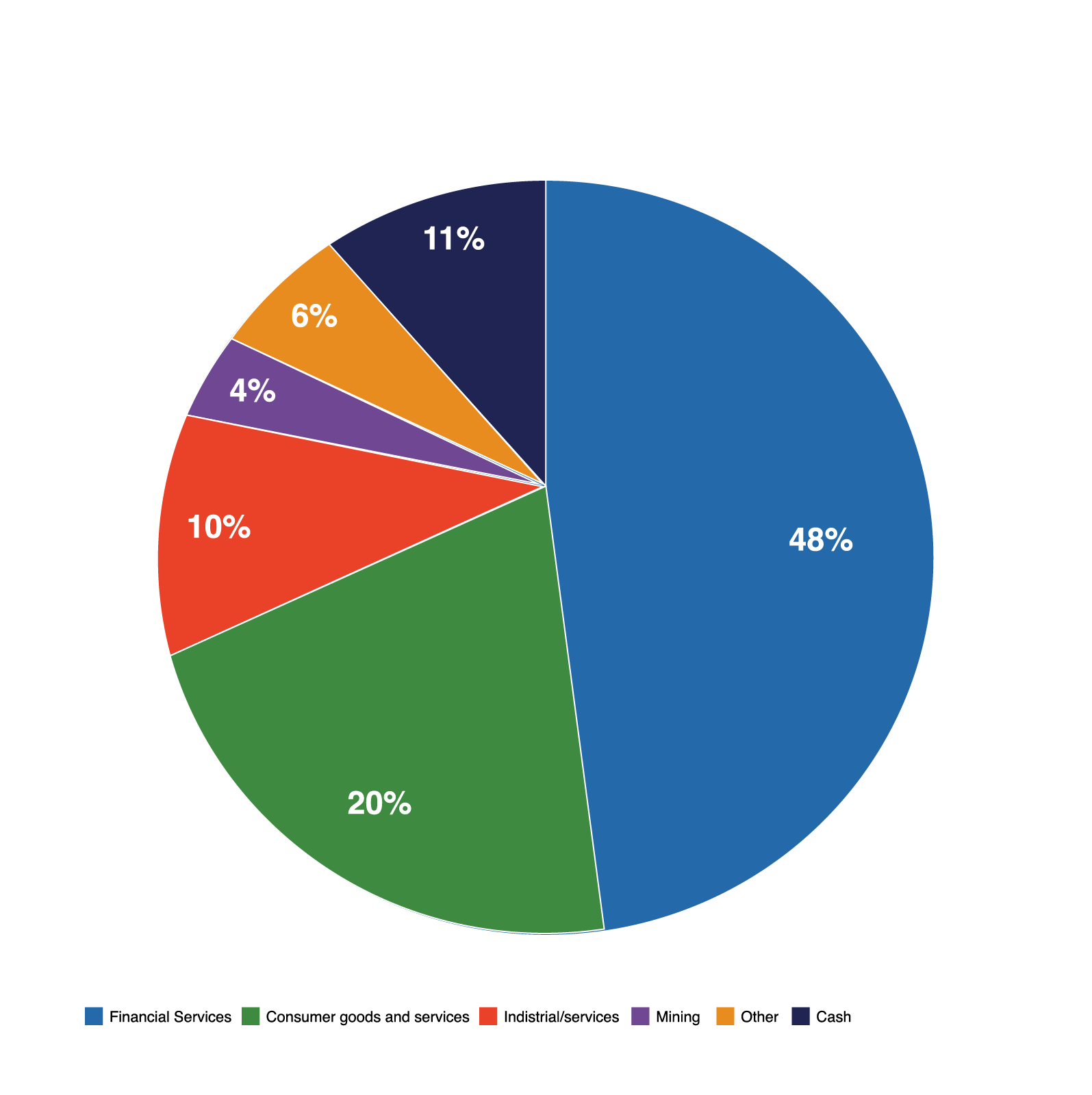

Existing Sector Mix With Current Investments as at 2023.

INVESTMENT HOLDINGS

WDB Investment Holdings (Pty) Ltd is a fully women led and managed investment holding company with over 21 years’ investment experience in South Africa across many sectors and industries.

catalysts

OF REFORM

WDB is catalyst of reform through strategic investments in the corporate sector and the development of women entrepreneurs.

The WDBIH team has very clear goals and a sound growth philosophy based on the pillars below:

Patient

INVESTMENTS

through taking a longer-term investment view and by seeking significant influence in the companies in which we invest.

Sustainable

TRANSFORMATION

through the appointment of women at executive and board levels, skills development, affirmative procurement and enterprise development

Active Strategic

INVESTOR

through representation on boards, allowing us to influence strategy.

Value Driven

PARTNERSHIPS

through investing in companies that are committed to South Africa and its BEE objectives and which share our values.

WDBIH is an active partner, adding strategic value to investments through board representation and ensuring that women empowerment and skills transfer are always at the top of the agenda.

EXITED INVESTMENTS

- Sold our 20% equity stake in RPC Astrapak, a specialised manufacturer of packaging products serving the African market.

INVESTMENT CRITERIA

- Specific sectors: financial services, consumer goods and services, education, property, technology media & telecoms, renewable energy/utilities, healthcare and pharmaceuticals, and diversified industries

- Robust listed and unlisted companies with:

- Reputable management, diversified income streams and which are high-growth and/or strong cash-generative businesses committed to BEE and women empowerment

- Demonstrable market traction and scalability

- Companies that achieve the required returns: We seek maximum returns through conservatively managed reasonable gearing/debt (including vendor and third-party funding) and equity

- Companies that give access to cash flows: We generally arrange trickle dividends and/or performance fees/management fees to secure cash flow for WDBIH

- Targeted business Enterprise Value:

- Growth and cash generative businesses with EVs of > R500 m